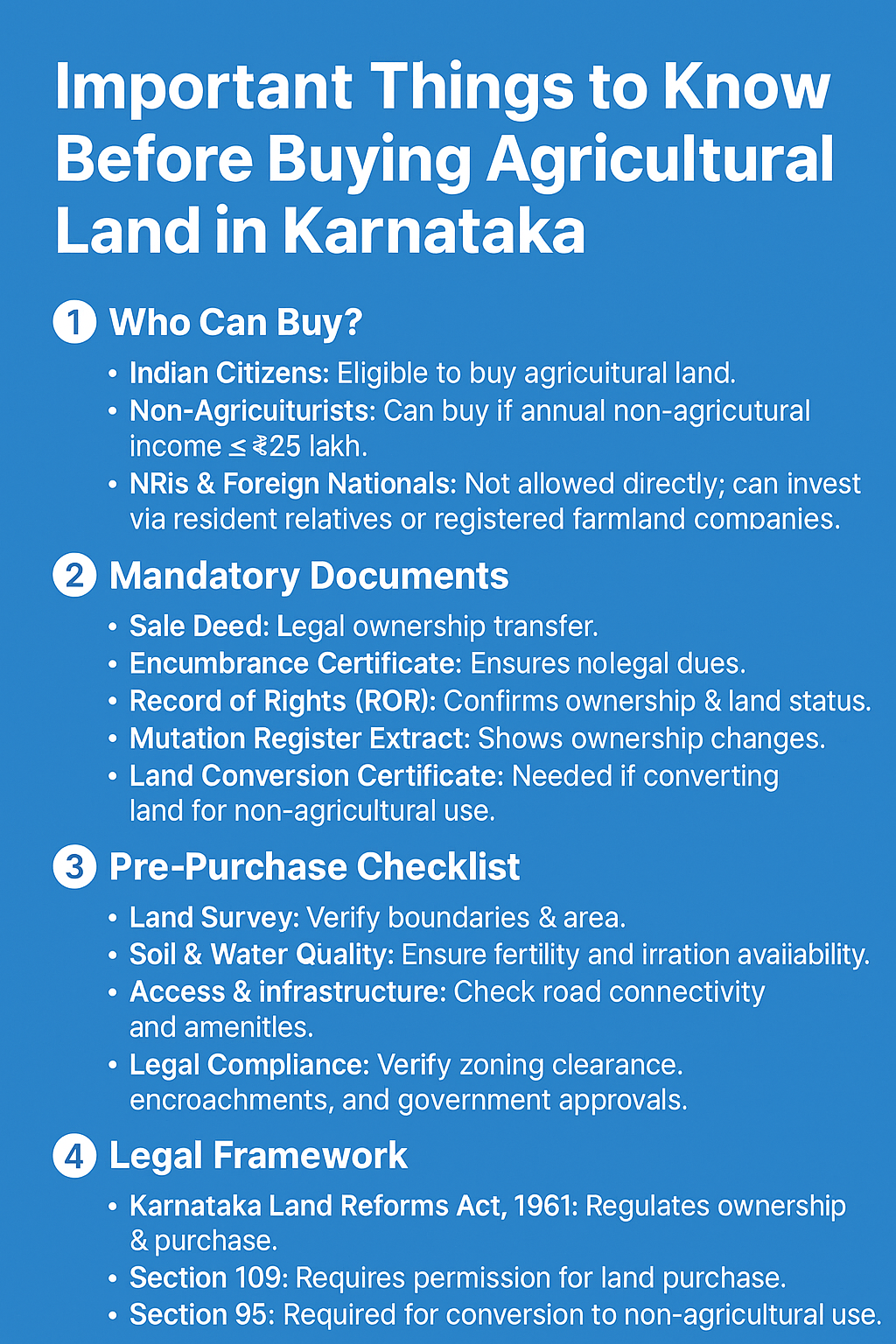

Important things to know before buying agricultural land in Karnataka

Buying agricultural land in Karnataka involves more legal and regulatory considerations than residential or commercial property. Here’s a detailed checklist of important things to know before buying agricultural land in Karnataka, especially after the 2020 amendments:

✅ 1. Legal Eligibility to Buy Agricultural Land

- Before 2020: Only farmers (registered) could buy agricultural land in Karnataka.

- After 2020 Amendment:

- Anyone can now purchase agricultural land (no farming background needed).

- The income limit of ₹25 lakh and other restrictions have been removed.

However:

- NRI/PIOs still cannot purchase agricultural land in India under FEMA laws.

📜 2. Essential Legal Documents to Verify

- RTC (Record of Rights, Tenancy & Crops)

- Confirms the titleholder, land type, and cultivation history.

- Obtain from Bhoomi portal.

- Mutation Extract (MR)

- Shows ownership changes and property transfers.

- Pahani

- Local term for land record — contains details of survey number, area, soil type, etc.

- Encumbrance Certificate (EC)

- Confirms the land is free from legal dues or mortgages (get from Sub-Registrar’s office).

- Form 10, 11 & 12

- Village form records confirming land revenue and tax payments.

- Conversion Order (if applicable)

- If the land is partially converted for non-agricultural use, verify DC conversion.

🗺️ 3. Physical Land Verification

- Survey the Land with a licensed surveyor to verify boundaries.

- Check for Disputes: Avoid land under litigation or joint family ownership.

- Zoning: Make sure land is not part of protected forest, lakebed, green belt, etc.

💧 4. Infrastructure & Utility Access

- Water Source: Verify borewell, river, or canal irrigation availability.

- Electricity: Ensure agricultural connection (separate from domestic).

- Access Roads: Check if land has direct road access — ideally a “patta road” or public road.

🚫 5. Restrictions & Prohibited Lands

Avoid:

- Inam lands (gifted lands, unless re-granted)

- Gomala (grazing) land

- Forest land (even if privately held – often non-transferable)

- Land under litigation or pending acquisition

🧾 6. Tax & Revenue Compliance

- Confirm all land revenue (kandaya) is paid up to date.

- Ensure no pending loans or crop insurance claims on the land.

🔄 7. Land Conversion (if you plan non-agriculture use)

- To use for residential, industrial, or commercial purpose:

- Apply for DC conversion (District Commissioner).

- After conversion, apply for Khata transfer and building permissions.

👨⚖️ 8. Use a Local Advocate or Consultant

- Land deals in Karnataka can be complex, especially in rural areas.

- Hire a local lawyer or property consultant to:

- Conduct due diligence

- Validate documents in Kannada

- Draft Sale Agreement and Sale Deed

- Register the deed with Sub-Registrar

🧠 9. Other Practical Tips

- Always get a registered sale deed, not just a GPA (General Power of Attorney).

- Avoid oral agreements — insist on written, signed, and witnessed documents.

- Verify whether tenant rights (if any) exist on the land.

- If buying large acreage, confirm if land ceiling laws apply (as per Karnataka Land Reforms Act).